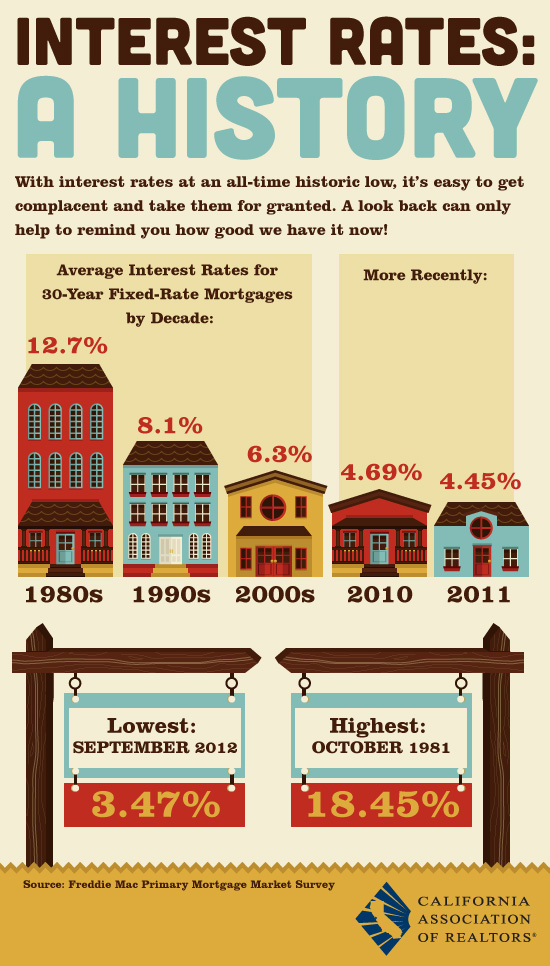

The California Associtaion of Realtors recently released the following infographic to help put into perspective how great the interest rates are right now.

If you bought an $85,000 home in 1980 with 20% down payment and an average interest rate for that decade of 12.7%, your payment would be the approximately the same as it would be for a $200,000 home at today's rates hovering around 3.5%.

Your principal and interest payment for the $85,000 home at 12.5% in the 1980s would be $900. The total cost over 30 years would be $326,000 with $241,000 in total interest paid.

Your principal and interest payment for a $200,000 home at 3.5% today would also be $900. The total cost over 30 years would be $323,000 with $123,000 in total interest paid.

Pretty amazing, if you ask me.

Stupid..If you paid the down the principle it would cost less then $200K home in 2012.

Posted by me on Wednesday, December 30th, 2015 at 6:55pmUh... Did you read the article? It holds the principal and time period constant. The whole point was that your monthly payment and the total amount paid would have been nearly the same over 30 years, which is a mathematical fact, not an opinion. That doesn't factor in that the value of a dollar was much higher in 1980 either, so really, the cost was much higher then.

Posted by Patrick Hake on Wednesday, December 30th, 2015 at 7:42pmLeave A Comment