Want to Assume a Low Interest Rate? - 5 Key Details to Consider

Posted by Patrick Hake on

Why Consider an Assumable Loan?

Why Consider an Assumable Loan?

Current interest rates are hovering somewhere around 7%. By assuming an existing loan, you may be able to find a rate closer to 3-3.5%! This can significantly reduce your monthly payments and overall interest paid over the life of the loan.

So what is the catch?

- Owner-Occupant Requirement: Most assumable loans are government-backed FHA or VA loans that require the buyer to be an owner-occupant. Unfortunately, this means investors are not eligible in most cases.

- Significant Down Payment: You’ll need to cover the difference between the home’s purchase price and the existing loan balance. This typically requires a down payment of at least $75,000 to $100,000 or much more if the home has been owned for many…

297 Views, 0 Comments

What a year!

What a year!

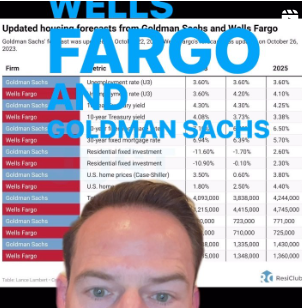

Over the past two years rising interest rates have had a massive impact on the real estate market.

Over the past two years rising interest rates have had a massive impact on the real estate market.

The new California Dream for All program offers a unique opportunity for California residents to partner with the state in an equity share down payment assistance program.

The new California Dream for All program offers a unique opportunity for California residents to partner with the state in an equity share down payment assistance program. As interest rates have risen over the past year, it has become progressively more difficult for home buyers to qualify to purchase homes in the same price range that they could afford at lower interest rates.

As interest rates have risen over the past year, it has become progressively more difficult for home buyers to qualify to purchase homes in the same price range that they could afford at lower interest rates.

For most currently listed homes, buyers are firmly in the driver’s seat during negotiations.

For most currently listed homes, buyers are firmly in the driver’s seat during negotiations.