Placer County Real Estate Update: May Statistics & Market Trends

Posted by Patrick Hake on

Welcome to our monthly Placer County real estate update! In this post, we'll delve into the latest statistics and market trends for May. Whether you're a buyer, seller, or real estate enthusiast, this update will provide valuable insights into the current state of the market.

Welcome to our monthly Placer County real estate update! In this post, we'll delve into the latest statistics and market trends for May. Whether you're a buyer, seller, or real estate enthusiast, this update will provide valuable insights into the current state of the market.

Key Highlights:

- 42% Increase in Listings: May saw a significant uptick in the number of homes for sale compared to the previous year.

- Faster Sales: Homes are selling at a quicker pace, with an average of 28 days on the market.

- Stable Prices: Despite the increase in listings, the average price per square foot has remained steady at $341.

- Inventory Levels: Currently standing at 1.7 months, the inventory favors sellers but is showing signs of softening for buyers.

241 Views, 0 Comments

Why Consider an Assumable Loan?

Why Consider an Assumable Loan?

Are you keeping tabs on the pulse of the Placer County real estate market? If you're a buyer, seller, or simply an enthusiast of housing trends, buckle up for a concise yet comprehensive update on what's been happening in our local market.

Are you keeping tabs on the pulse of the Placer County real estate market? If you're a buyer, seller, or simply an enthusiast of housing trends, buckle up for a concise yet comprehensive update on what's been happening in our local market.

What a year!

What a year!

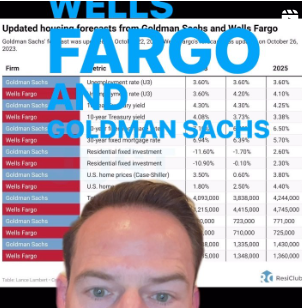

Over the past two years rising interest rates have had a massive impact on the real estate market.

Over the past two years rising interest rates have had a massive impact on the real estate market.

I tend to report the medians and averages for the market as a whole because they give us the best indicator of what is happening in general.

I tend to report the medians and averages for the market as a whole because they give us the best indicator of what is happening in general.

Home prices in Placer County reached their most recent peak in April/May of 2022.

Home prices in Placer County reached their most recent peak in April/May of 2022.

The new California Dream for All program offers a unique opportunity for California residents to partner with the state in an equity share down payment assistance program.

The new California Dream for All program offers a unique opportunity for California residents to partner with the state in an equity share down payment assistance program. As interest rates have risen over the past year, it has become progressively more difficult for home buyers to qualify to purchase homes in the same price range that they could afford at lower interest rates.

As interest rates have risen over the past year, it has become progressively more difficult for home buyers to qualify to purchase homes in the same price range that they could afford at lower interest rates.